Medium term outlook for LNG

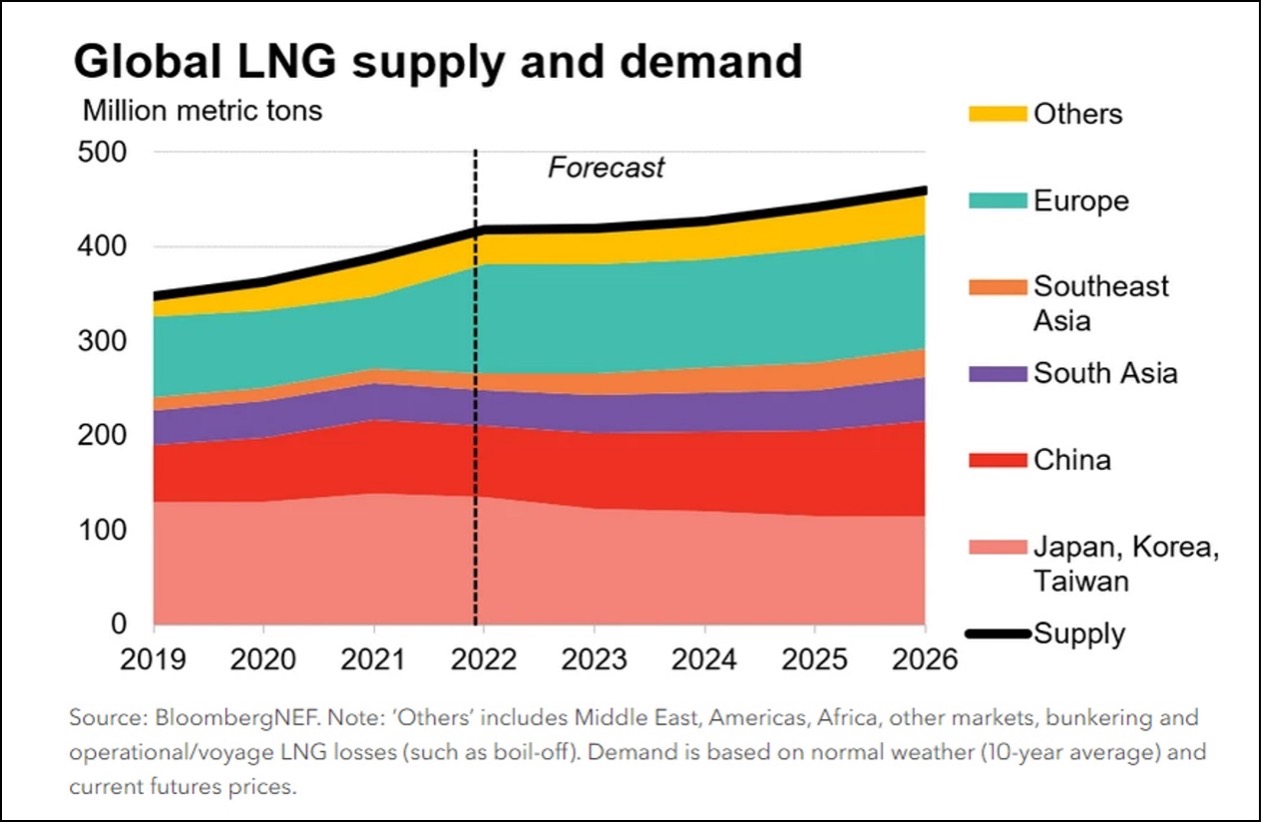

The global LNG market is expected to be tight over 2022-26 as Europe’s quest to reduce its dependency on Russian gas increases demand for LNG. This will curb gas demand growth in China and emerging Asia as the European market outbids these buyers for the limited amount of flexible LNG supply.

To attract the LNG needed to replace Russian pipeline gas to Europe, BNEF expects US LNG netbacks for European TTF prices to be higher than Asia’s benchmark JKM for the forecast period 2022-26. With tight supply anticipated in the coming five years, prices are expected to remain at elevated levels compared to historical averages over 2017-19, before Covid-19.

The ramp-up of new supply projects, especially in the US, is forecast to raise global supply to 460 million tons, up 19% from 2021. LNG demand growth is likely to be constrained by supply between 2021-26, with 18% growth estimated, although Europe is expected to see imports spike during the period, as shown below.

The expectation of high LNG prices may drive producers to ramp up flexible supply and increase spot volume. Investments in liquefaction facilities are likely to accelerate, but most are unlikely to add supply before 2026, given the lead time needed to construct a new plant. Development concepts for LNG projects with shorter start-up timelines could bring much-needed supply earlier, but unforeseeable delays and sanctions could reduce supply too.

Asian consumers will suffer most from the expected tight market. Price-sensitive buyers in China and South and Southeast Asia will be forced to reduce LNG imports and replace them with pipeline imports (in the case of China) or other fuels. Downstream users, especially in the power and industrial sectors, will need to reduce operations to cut gas consumption.

Global small-scale LNG market

The small-scale LNG market is projected to grow from USD 46,4 billion in 2023 to USD 92,8 billion by 2028, recording a CAGR of 14.9% during the forecast period.

The small-scale LNG market is being propelled by several significant factors. First and foremost is the energy cost advantage offered by small-scale LNG solutions. Compared to other conventional fuels, LNG has a lower cost, making it an attractive option for various applications. Additionally, small-scale LNG provides environmental benefits as it emits lower greenhouse gases and pollutants compared to traditional fossil fuels. This aligns with the increasing global focus on sustainability and cleaner energy sources. Furthermore, there is a growing demand for small-scale LNG across diverse sectors such as heavy-duty vehicles, industrial and power generation, and marine transport. This demand is driven by the need for efficient and cleaner energy solutions in these industries. Altogether, the combination of energy cost advantage, environmental benefits, and expanding demand from various applications positions small-scale LNG as a key player in the energy market, shaping a more sustainable and diverse energy landscape.

Transportation applications are expected to dominate the small-scale LNG market, owing to the increasing demand for LNG as a fuel source for ships and heavy-duty trucks. Owing to the high capital expenditure required for a small-scale LNG infrastructure, the development of cost-efficient small-scale LNG infrastructure is expected to provide significant opportunities to the small-scale LNG technology providers and transporters in the future. Asia-Pacific dominated the market across the world, with most of the demand coming from countries such as Japan, China, and South Korea.

Formed in 2019 by the European Commission, the European Green Deal is a set of policy initiatives with an aim to make Europe carbon-neutral by 2050. The policies briefly underline the importance of LNG in reaching the aim, and they emphasize the usage of LNG as fuel for trucks and marine vessels.

New emerging economies are also planning to lay foundations for the future of LNG for transportation. For instance, in 2020, the Indian government, announced the commencement of construction for 50 new LNG fuelling stations on the Golden Quadrilateral highway connecting Delhi, Mumbai, Chennai and Kolkata. Additionally, India will also see an investment of INR 10,000 crore from the private and public sector for setting up of 1 000 LNG stations by 2023.

Hence, owing to the above-mentioned factors, the demand for small-scale LNG infrastructure for the transportation segment is likely to grow and significantly dominate the market during the forecast period. In addition, the possibility of expanding the portfolio to include hydrogen liquefaction can open a very large and rapidly growing market and it is anticipated that the long-term zero carbon focus of the company (PTI) would be on bio-LNG and liquid hydrogen technologies and applications.